Thursday, July 23, 2009

Flower

Yesterday I decided to buy a lovely porch flower. It was $9.99 plus tax and if I can keep it alive for the rest of the summer I will be happy. Unfortunately I don't have a green thumb so am a bit worried about this. Time will tell!

Monday, July 20, 2009

Stay focused

I've been working hard and staying focused, which is what it takes to get out of debt. The extra funds from my last two paychecks have mostly gone to my personal debt and the balance now is onyl $480!

Last week I returned some items from a MLM deal I never should have got involved with and received a credit of $290 to my bank account today. -- To add to this, I also made some extra money ($70) by helping some strangers move into their new home. It was random and unexpected, but very welcomed by me and my BF who also made money.

I will combine the $290 and $70 ($360) and with my paycheck this week add $120 to pay off my personal loan. I'm glad to know this will be paid off this month instead of August.

My sidebar has been updated, I can't believe how much I have paid off this year!!!

UPDATE! Actually, the credit was for $387 but they made originally made a mistake, so I took this, plus the $70 and a little extra I had and PAID OFF MY PERSONAL LOAN!!!! It's done! I'm no longer a slave to this lender!!! ;)

The car and AMEX are all I have left. I'm so happy about this today!

Last week I returned some items from a MLM deal I never should have got involved with and received a credit of $290 to my bank account today. -- To add to this, I also made some extra money ($70) by helping some strangers move into their new home. It was random and unexpected, but very welcomed by me and my BF who also made money.

I will combine the $290 and $70 ($360) and with my paycheck this week add $120 to pay off my personal loan. I'm glad to know this will be paid off this month instead of August.

My sidebar has been updated, I can't believe how much I have paid off this year!!!

UPDATE! Actually, the credit was for $387 but they made originally made a mistake, so I took this, plus the $70 and a little extra I had and PAID OFF MY PERSONAL LOAN!!!! It's done! I'm no longer a slave to this lender!!! ;)

The car and AMEX are all I have left. I'm so happy about this today!

Saturday, June 13, 2009

Changed plan of attack!

Nearly two months have gone by since I last posted, but I am still on the get out of debt wagon! I've been doing well so far and have killed over $6,000 of my debt which is so exciting!

A few of my goals / plans have changed since then. Last month I did well on ebay and with the help of other funds I had available, paid off Capital One 2. This is the card that was only charging me 3.99% interest and that I had planned to pay off last due to the low rate. I decided that I just wanted it gone...and when they charged me a $39 yearly fee, that was it! I called them and asked them if they would remove the fee if I paid off my account and closed it. They agreed.

Funny thing though, you know when you try to cancel a credit card they do just about anything to keep you? Well, the man I talked to didn't even try. When he asked me why I wanted to close the account I just told him that I wanted to get rid of all my credit cards. No questions asked...and I was so thankful for that.

Now, all I have left are: Personal Loan, Car and American Express. I will pay them off in that order. In fact, I noticed my last post said that I would have the personal loan paid off by December of this year...that has changed. I now plan to pay it off by August/September!!! Next to be attacked is my car which will be paid off maybe by April/May 2010. The loan schedule shows it to be paid if full by Sept. 2011 so I'll be pretty early on that one. Last will be AMEX which could take me until December 2010 and hopefully not longer than that!

It feels so great to know that I only owe on one credit card and my total debts are only three! I can't wait to be FREE!

A few of my goals / plans have changed since then. Last month I did well on ebay and with the help of other funds I had available, paid off Capital One 2. This is the card that was only charging me 3.99% interest and that I had planned to pay off last due to the low rate. I decided that I just wanted it gone...and when they charged me a $39 yearly fee, that was it! I called them and asked them if they would remove the fee if I paid off my account and closed it. They agreed.

Funny thing though, you know when you try to cancel a credit card they do just about anything to keep you? Well, the man I talked to didn't even try. When he asked me why I wanted to close the account I just told him that I wanted to get rid of all my credit cards. No questions asked...and I was so thankful for that.

Now, all I have left are: Personal Loan, Car and American Express. I will pay them off in that order. In fact, I noticed my last post said that I would have the personal loan paid off by December of this year...that has changed. I now plan to pay it off by August/September!!! Next to be attacked is my car which will be paid off maybe by April/May 2010. The loan schedule shows it to be paid if full by Sept. 2011 so I'll be pretty early on that one. Last will be AMEX which could take me until December 2010 and hopefully not longer than that!

It feels so great to know that I only owe on one credit card and my total debts are only three! I can't wait to be FREE!

Saturday, April 18, 2009

Estimated pay off date for Personal Loan

After making out my budget for a year and a half, I calculated that my personal loan will be paid off in December 2009. For a long time I was only paying $20 / $40 here and there, but now I've worked my way up to $50 per month, for the next two months. In July, I'm bumping it up to $225 per month (and possibly more). Again, all this is assuming my finances remain the same.

I struggled with this debt for a while as far as what priority to give it, because the person is not charging me any interest and doesn't need the money, I know this to be true. In fact, the times when I've brought up repaying the loan, she has told me not to worry about it.

Anyhow, it was a loan from a friend and although it is at zero interest, it should receive priority.

I struggled with this debt for a while as far as what priority to give it, because the person is not charging me any interest and doesn't need the money, I know this to be true. In fact, the times when I've brought up repaying the loan, she has told me not to worry about it.

Anyhow, it was a loan from a friend and although it is at zero interest, it should receive priority.

Friday, April 17, 2009

Payday...and I'm broke!

Oh, how I ♥ paydays! It's funny though, because it's not that I'm excited to have money in my account so I can go shopping for things I really don't need. It's more exciting for me to know that I'm one step closer to being debt free!!

A couple of weeks ago, I set up a budget on Excel through the end of 2011. Yes, the year 2011. According to my figures, this is how long it will take me to become debt free. That is, of course, dependent on my income remaining where it is now and my expenditures also being stable, ie. rent, gas, electricity, food, etc. Also, I did not figure any money made through extra avenues such as ebay, the possible occasional yard sale, odd jobs, etc.

So, today I was happy to be able to go online, see the balance in my checking account and pay some bills. It's funny though, because I'm always broke even if I just got paid. I've turned down a lot of things lately such as going out to eat and buying things I normally wouldn't think twice about. My eating habits have changed, I'm eating homemade beans :) and they're damn good!!

A couple of weeks ago, I set up a budget on Excel through the end of 2011. Yes, the year 2011. According to my figures, this is how long it will take me to become debt free. That is, of course, dependent on my income remaining where it is now and my expenditures also being stable, ie. rent, gas, electricity, food, etc. Also, I did not figure any money made through extra avenues such as ebay, the possible occasional yard sale, odd jobs, etc.

So, today I was happy to be able to go online, see the balance in my checking account and pay some bills. It's funny though, because I'm always broke even if I just got paid. I've turned down a lot of things lately such as going out to eat and buying things I normally wouldn't think twice about. My eating habits have changed, I'm eating homemade beans :) and they're damn good!!

Thursday, April 16, 2009

Why I will NEVER do business with WELLS FARGO again!

Apparently I’m laundering money…or something, according to Wells Fargo. Yes, me, I’m out there up to no good, you know, working hard, making money, paying off my debts. It’s all totally legal and they closed my credit card account due to “suspicious activity.”

I can’t tell you how mad I was am at them! I WILL NEVER DO BUSINESS WITH WELLS FARGO AGAIN!

FIRST INCIDENT

I had paid off my credit card and my brother asked me to get him some concert tickets which he gave me the money for. It had to be done online with a card, so I figured I would get the rewards points and use the WF card. No brainer right? Got the tickets purchased, done.

During this time I also paid WF the amount of the tickets so they would be covered. This charge didn’t go through for a few days and since my account was “overpaid” it sent a GIANT RED FLAG to WF’s Fraud Department.

They blocked my card and I had to call them. The only thing their brilliant rep told me was to not overpay my account again. Ok, no big deal. It was an accident, I guess, if you could say that. Even though I had a charge going through, they don’t like that. -- Don’t overpay your account.

SECOND INCIDENT

Again my card was blocked, only a few weeks later and I had to call WF to find out why. This time a different rep told me that a lot of people launder money by overpaying their accounts. Also, that I was making so many payments and charging things, ie. make a payment of $200 and then charge $200. Um, yeah, I used it like a debit card…for the points. Whatever.

He told me that if this happened again, WF would close my account without notice. Fine, whatever. The information received from both of the reps was different.

THE CLOSURE

Within a month I was at the grocery store and used tried to use my WF card but it didn’t go through. I was puzzled. Swiped the card again…same thing. What the?! Alright, paid another way.

When I got to my car I called WF and apparently my account had been closed that very day. The Fraud rep told me something I had not heard from the other two reps I spoke to, which I did let him know.

He did confirm that people launder money by overpaying accounts and what I was told is true. However, the reason the account was closed, according to him, is that I was using more than my available credit during one billing cycle.

In other words, if you have a credit card with a $1,000 limit, THIS IS ALL YOU CAN USE IN ONE BILLING CYCLE. No, you cannot charge $1,000 on Monday, pay it off Tuesday, charge $1,000 on Wednesday to turn around and pay it off on Thursday. You would be using more than what they “allow” you to use in one month….even if you pay it off!!

The rep told me you cannot, “boost your credit limit,” by paying an extra amount than what is owed.

I told the WF rep that I was not told this by the other two reps, which he apologized for, but really it does me no good when the account has been closed.

He also said he would appeal this closure due to being told incomplete information and see if anything could be done… he would let me know the answer in a few days. When he told me, IF ANYTHING, WF would ask me to re-apply for a new card, I made sure to let him know I would NOT be doing business with WF again if my card was not re-opened.

Never heard from him again.

The thing that makes me really mad is that I was a WF customer from 1996-2009 and THEY closed my account due to their lack of their representatives efficiency. This will also reflect on my credit report and could possibly / likely lower my score and affect my open account with AMEX. I sure hope it doesn’t!

The icing on this cake is….I was going to get a $100 Wells Fargo Cash Reward on the next statement. Now, I can’t.

I can’t tell you how mad I was am at them! I WILL NEVER DO BUSINESS WITH WELLS FARGO AGAIN!

FIRST INCIDENT

I had paid off my credit card and my brother asked me to get him some concert tickets which he gave me the money for. It had to be done online with a card, so I figured I would get the rewards points and use the WF card. No brainer right? Got the tickets purchased, done.

During this time I also paid WF the amount of the tickets so they would be covered. This charge didn’t go through for a few days and since my account was “overpaid” it sent a GIANT RED FLAG to WF’s Fraud Department.

They blocked my card and I had to call them. The only thing their brilliant rep told me was to not overpay my account again. Ok, no big deal. It was an accident, I guess, if you could say that. Even though I had a charge going through, they don’t like that. -- Don’t overpay your account.

SECOND INCIDENT

Again my card was blocked, only a few weeks later and I had to call WF to find out why. This time a different rep told me that a lot of people launder money by overpaying their accounts. Also, that I was making so many payments and charging things, ie. make a payment of $200 and then charge $200. Um, yeah, I used it like a debit card…for the points. Whatever.

He told me that if this happened again, WF would close my account without notice. Fine, whatever. The information received from both of the reps was different.

THE CLOSURE

Within a month I was at the grocery store and used tried to use my WF card but it didn’t go through. I was puzzled. Swiped the card again…same thing. What the?! Alright, paid another way.

When I got to my car I called WF and apparently my account had been closed that very day. The Fraud rep told me something I had not heard from the other two reps I spoke to, which I did let him know.

He did confirm that people launder money by overpaying accounts and what I was told is true. However, the reason the account was closed, according to him, is that I was using more than my available credit during one billing cycle.

In other words, if you have a credit card with a $1,000 limit, THIS IS ALL YOU CAN USE IN ONE BILLING CYCLE. No, you cannot charge $1,000 on Monday, pay it off Tuesday, charge $1,000 on Wednesday to turn around and pay it off on Thursday. You would be using more than what they “allow” you to use in one month….even if you pay it off!!

The rep told me you cannot, “boost your credit limit,” by paying an extra amount than what is owed.

I told the WF rep that I was not told this by the other two reps, which he apologized for, but really it does me no good when the account has been closed.

He also said he would appeal this closure due to being told incomplete information and see if anything could be done… he would let me know the answer in a few days. When he told me, IF ANYTHING, WF would ask me to re-apply for a new card, I made sure to let him know I would NOT be doing business with WF again if my card was not re-opened.

Never heard from him again.

The thing that makes me really mad is that I was a WF customer from 1996-2009 and THEY closed my account due to their lack of their representatives efficiency. This will also reflect on my credit report and could possibly / likely lower my score and affect my open account with AMEX. I sure hope it doesn’t!

The icing on this cake is….I was going to get a $100 Wells Fargo Cash Reward on the next statement. Now, I can’t.

Leftovers

My BF made a frozen pizza for lunch today (which by the way was free after rebate!) which sounds great, but is a problem...or used to be! The reason it used to be and isn't anymore is that frozen pizza, once it has been cooked, isn't good when reheated. It's gross!

Anyhow, today I thought, I'm not letting this pizza go to waste...again. So, I turned the oven on broil, microwaved it for a minute and then stuck it in the oven. It came out crispy and yummy!

Consumed leftovers & saved money = happy me.

Anyhow, today I thought, I'm not letting this pizza go to waste...again. So, I turned the oven on broil, microwaved it for a minute and then stuck it in the oven. It came out crispy and yummy!

Consumed leftovers & saved money = happy me.

Saturday, April 4, 2009

Updated sidebar

Today I paid WF $250 and my car $180 so updated the sidebar. It's gratifying to see the numbers get smaller and smaller each payday.

I'll be so ecstatic when they are ALL paid off!!

I'll be so ecstatic when they are ALL paid off!!

Friday, April 3, 2009

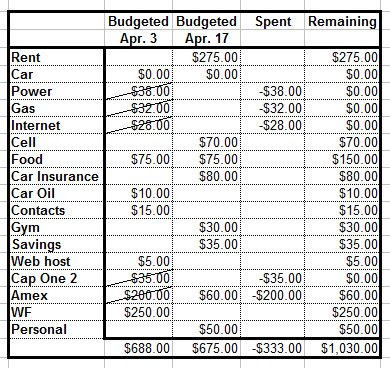

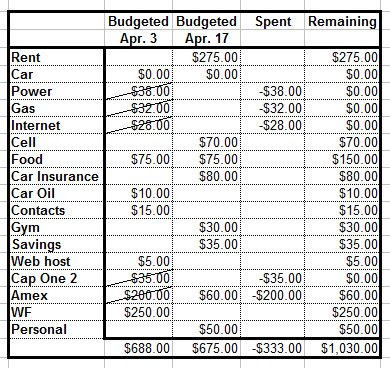

April Budget

UPDATE: I decided showing my budget on Excel this way is just too much work.

This month I'm not putting money aside for my car payment because I get paid May 1st which is three days before my next payment.

This month I'm not putting money aside for my car payment because I get paid May 1st which is three days before my next payment.

My paycheck was about $750 so you would think I have money left over, but actually I went shopping for things to sell on ebay. I have some paying back to myself to do!

This month I'm not putting money aside for my car payment because I get paid May 1st which is three days before my next payment.

This month I'm not putting money aside for my car payment because I get paid May 1st which is three days before my next payment.My paycheck was about $750 so you would think I have money left over, but actually I went shopping for things to sell on ebay. I have some paying back to myself to do!

Loaning money

Have you ever loaned money to someone and they say, "I'll pay you back next week when I get paid."? I've loaned money out many times over the years, to family, and it always seems that they don't pay me when they say they will.

Suddenly, when "next week" comes and they get paid, they realize that other bills need to be paid and use their paycheck for the bills instead. As if they need my money more than I do. Or, because I had the ability to loan it, I really don't "need" it. That's a bunch of B.S.!!

I'm so upset that this has happened once again. I realize it is my fault for loaning the money in the first place, but there is so much more to the reason she (in this case) needs the money, which is why I did it.

We're not talking thousands of dollars or anything, but just $200, for three different things. Anyhow, it's my money and I want it back!! Her payday has come and gone. Then comes the attempted guilt trip of, "I'm going to sell (fill in the blank) so I can pay you, does that make you happy?!?!" Um, no, but that's just not my problem. You borrowed and owe me. Period.

I just wish people would learn to manage their money and not come to me for my hard earned cash.

~Still trying to get out of debt.

Suddenly, when "next week" comes and they get paid, they realize that other bills need to be paid and use their paycheck for the bills instead. As if they need my money more than I do. Or, because I had the ability to loan it, I really don't "need" it. That's a bunch of B.S.!!

I'm so upset that this has happened once again. I realize it is my fault for loaning the money in the first place, but there is so much more to the reason she (in this case) needs the money, which is why I did it.

We're not talking thousands of dollars or anything, but just $200, for three different things. Anyhow, it's my money and I want it back!! Her payday has come and gone. Then comes the attempted guilt trip of, "I'm going to sell (fill in the blank) so I can pay you, does that make you happy?!?!" Um, no, but that's just not my problem. You borrowed and owe me. Period.

I just wish people would learn to manage their money and not come to me for my hard earned cash.

~Still trying to get out of debt.

Subscribe to:

Posts (Atom)